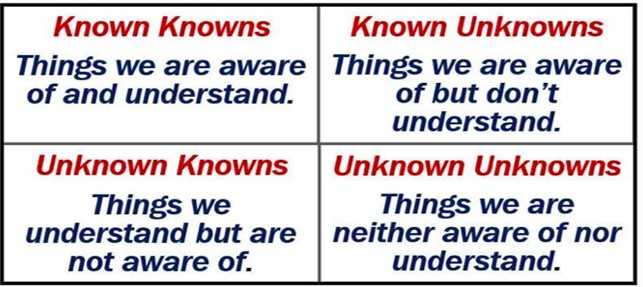

These 4 principles of “known/unknown” (知之为知之,不知为不知) could be applied in stock investing strategies to enhance the probability of success, no need to worry about future known.

1) Known Knowns

– This could be safer way of investing, focusing in known giant stocks with consistent growing business, protected by strong economic moat. Even the stock price could be high, it has higher chances to go higher in future.

In fact, why focus in fortune-telling, guessing the future stock prices or future business? There are lots of known facts which could be useful to make a decision. To avoid another unknown (eg. fake financial data), one could apply diversification over a portfolio of 10-20 giant stocks to minimize such unsystematic risks.

2) Unknown Knowns

– This is area of improvement for all stock investors, eg sharing knowledge in Ein55 forum, allowing us to know the knowns which are not known to oneself, learning from other people’s successes or mistakes (eg recent sharing of GIC / Temasek / Warren Buffett investment experience).

There are potential red flags, risk of business, which one could learn to minimize the risk (eg. high debt, negative free cash flow, etc), may avoid crisis such as Hyflux stock and bond investment with these known facts even more than 5 years before the company crisis.

Company such as Muddy Waters and Iceberg are supporters to find these unknown knowns, providing opportunity for shorting for potential profits by converting the unknown knowns to known knowns later to the general public.

One could convert “unknown knowns” to “known knowns”, strengthen own probability of success, eg. learning one new strategy or giant stock each week in this forum.

3) Known Unknowns

– This could be Coronavirus crisis (only after the breakout), weak global economic performance, high debt, etc, usually reported widely by analysts, stirring great fear in stock market. These are known risks but no one knows the ending, eg when Coronavirus may end.

For uncertain future, a better way is to apply probability investing with optimism strategy, eg buying giant stock at low optimism < 25%, applying multiple entries to fight against unknown future crisis.

Risk of known unknown is investor may be too fearful, dare not take the action of catch the falling knife, also missing the surge when crisis is fading, totally miss the investing opportunity, gift given by crisis.

4) Unknown Unknowns

– Good examples are black swans which no one knows before that and catch most people by surprise after happening, eg. Asian Financial Crisis in 1997 (Forex Crisis), Dotcom bubble (Technology Crisis) in 2000, Gulf War (Political Crisis) and SARS (Virus crisis) in 2003, Subprime Crisis (Property Crisis), Coronavirus Crisis (2020), and future black swan (we don’t know what and when will come, therefore called unknown unknowns).

It is meaningless to worry about sky would fall down (staying at home each day) as one would not able to take any action in stock investing, missing the opportunities. One has to learn to take calculated risks despite the unknown unknowns.

For future unknowns in systematic risks at regional or global level and unsystematic risks at business level (eg. management integrity, truthful financial report, etc), both could be minimized with LOFTP Strategies:

L = Levels 1-4 (stock, sector, country, world)

O = Optimism 0-100%

F = Fundamental (Strong / Weak)

T = Technical (Up / Flat / Down)

P = Personal (types of personality)

When we take care of downside in future uncertainties (known unknowns or unknown unknowns), upside in share prices will take care of itself (known knowns and unknown knowns in global giant stocks).

==================================

Drop by Dr Tee free 4hr investment course to learn how to position in global giant stocks with 10 unique stock investing strategies, knowing What to Buy, When to Buy/Sell.

Learn further from Dr Tee valuable 7hr Online Course, both English (How to Discover Giant Stocks) and Chinese (价值投资法: 探测强巨股) options, specially for learners who prefer to master stock investment strategies of over 100 global giant stocks at the comfort of home.

You are invited to join Dr Tee private investment forum (educational platform, no commercial is allowed) to learn more investment knowledge, interacting with over 9000 member.