It is hard to wait for Level 3 (country) and Level 4 (world) stock markets to fall, sometimes need to wait for 10+ years. The current crisis may not be a global financial crisis yet (require confirmation with weaker economy with falling of related market such as property) but it is definitely a stock crisis. Grab on this opportunity may help one to save 5-10 years of time (comparing to buy & hold), especially for cyclic stocks.

Sharing below is for education purpose, please make your own decision, aligning with own personality based on strategies learned.

I have just shared more details with Ein55 graduates (since they are fully trained) to position in current stock market. Please login to Ein55 graduate forum for 3000+ Ein55 graduates. Pay attention to Article on Ein55 Style No 53: Entry / Exit with Optimism.

For 200 students waiting to attend 6-day Ein55 course (www.ein55.com/course) in Jun, Aug & Oct 2020, hope you could wait patiently to learn the complete 55 Ein55 investing styles before taking action. If it is a global financial crisis, it may take 6-12 months to fall in prices, so you will have enough time to take action for new stock investment.

Sharing here is not a “stock tip” as it could hurt those who are not trained, eg may buy a junk stock with weak fundamental at low optimism, buy low get lower. Please put in effort to learn in next 12 months in stock investment to grab the opportunity of current stock crisis. Here are my views of these 5 major stock markets:

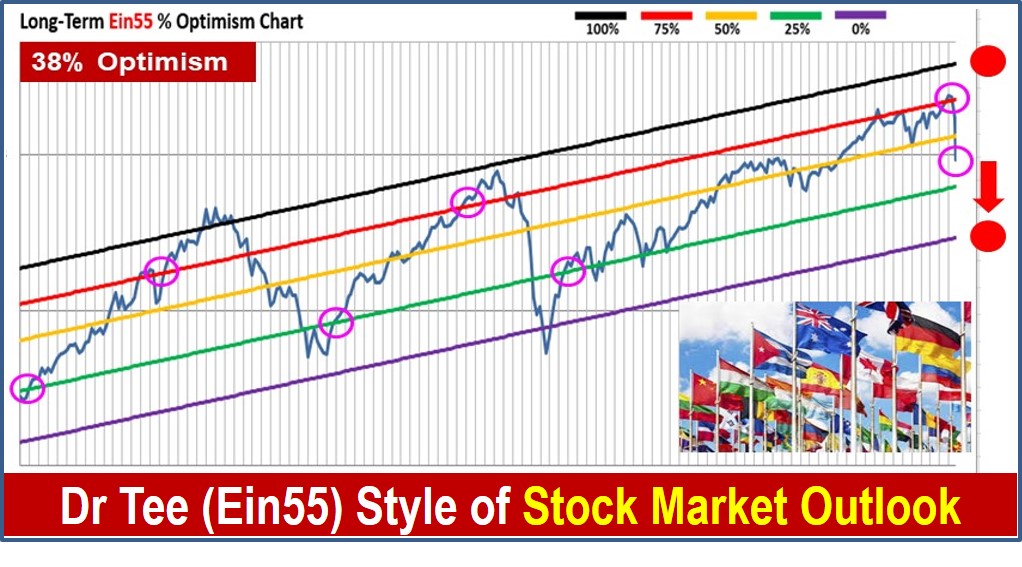

1) World

After double top crossing down from 75% optimism, finally optimism is below < 50%, dropping to moderate low 38% optimism, a danger signal as it is hard to recover in short term with such a low optimism, unless US could reverse with strong stimulus plan by Trump.

2) US

After triple top crossing down from 75% optimism, there is a sharp falling knife in optimism from over 90% to only 52% which is still a fair value, not low optimism yet.

Since US economy is still strong, so far the stock crisis is fear driven (Coronavirus pandemic + oil crisis + global travelling crisis), there is still possibility it may end up as global financial crisis, if Coronavirus could end in summer (possible, based on 3-4 months virus spreading cycle pattern in China). Regardless this is a fake or real crisis, it is a major correction to stock, so opportunity could be mid term trading to long term investing, depending on severity.

For trading (long), US stock market has to recover by 20% first, not a mission impossible but requires political economy by Trump to come out with a massive stimulus plan. In fact, last US interest rate 0.5% cut in falling of stock market from high optimism is proven to be a negative help as investors may feel economy is really affected (actually not yet). Ein55 graduates have learned in earlier 6 day Ein55 course on impact of interest rate (Ein55 Styles # 21 & 22), can understand better here.

3) Singapore

Optimism at 29% yesterday, hit 25% Optimism at intra-day today but so far recovering above it. Again, Singapore could only follow the world, especially US, therefore apply US / world optimism for longer term investor to make decision, not just on Singapore. However, this is a rare opportunity for Singapore to near to low optimism of 25%, some blue chips (eg. 3 major banks) could fall more than they should if not supported by company share buyback.

4) Hong Kong

Optimism at 27% yesterday, hit 25% Optimism at intra-day today but so far recovering above it. Position for Hong Kong market is similar as Singapore, need to follow US but also China (Coronavirus condition has improved, first to start, first to end). However, China contribution to world stock value is much less than US (over 50%), therefore the direction of US stock is more important.

5) China

Optimism at 26% yesterday hit 25% optimism at intra-day today but currently recovering above it. However, short term China stock is still bullish, could be the strongest short term stock market in the world now. However, China could not be totally insulated from the fear of global investors (especially with Shanghai and Shenzhen markets connect with Hong Kong exchange), hard to be bullish alone while the rest of the world is bearish.

====================

So, there is alignment in optimism for most Level 1 (individual) and Level 2 (sector) stocks with Level 3 (country) and Level 4 (world) stock markets. Some may need to wait for TA (Technical Analysis) for reversal, some could enter in batches (Ein55 graduates may see example of different personalities as you have learned in earlier 6-day Ein55 class on Style No 53: Entry/Exit with Optimism).

For current Ein55 coaching students, please work harder in your coming coaching homework, showing potential actions, either spring cleaning (especially for weaker stocks) or dream team stocks to buy. Some experienced traders may also apply shorting in current bearish market but need to follow SET trading plan: Stop Loss / Entry / Target Prices.

In general, readers may look for 2 main types of giant stocks (following Ein55 investing styles with over 1500 global giant stocks, at least 10 different stock investing or trading strategies could be applied)

1) Growth Stocks (Buy Low & Hold)

– Add dividend and defensive stocks as extra protection if needed.

– Certain growth stocks may not drop to low optimism < 25% due to strong business fundamental, then one may apply Levels 3-4 low optimism as criteria to buy these very strong growth stocks.

2) Cyclic Stocks (Buy Low & Sell High)

– Trend-following is crucial for cyclic stocks (eg. many global banks and property stocks are more than 20-50% discount), so that it won’t Buy Low get Lower. Holding power is crucial when investing in bearish stock market.

– Align L1 (even individual stock is already low optimism) with L2 (sector), L3 (country) and L4 (world) low optimism for better quality of opportunity.

Of course, Ein55 graduate may also look for pure dividend stocks or specific sectors (diversification is needed) or even for indices / ETF (USO – oil ETF, S&P 500 ETF – SPY, World stock ETF, etc) for those limited in capital but need diversification. Ideally, diversify over a portfolio of 10 – 20 giant stocks (max 5% risk if 20 stocks), entry / exit in batches (eg. 2-3 times) if capital is sufficient.

For general public (non-Ein55 graduate), you may start your investment journey at the right time now with stock market crisis, learning from Dr Tee 4hr free stock investment course on LOFTP strategies (Level / Optimism / Fundamental / Technical / Personal Analysis). Register Here: www.ein55.com