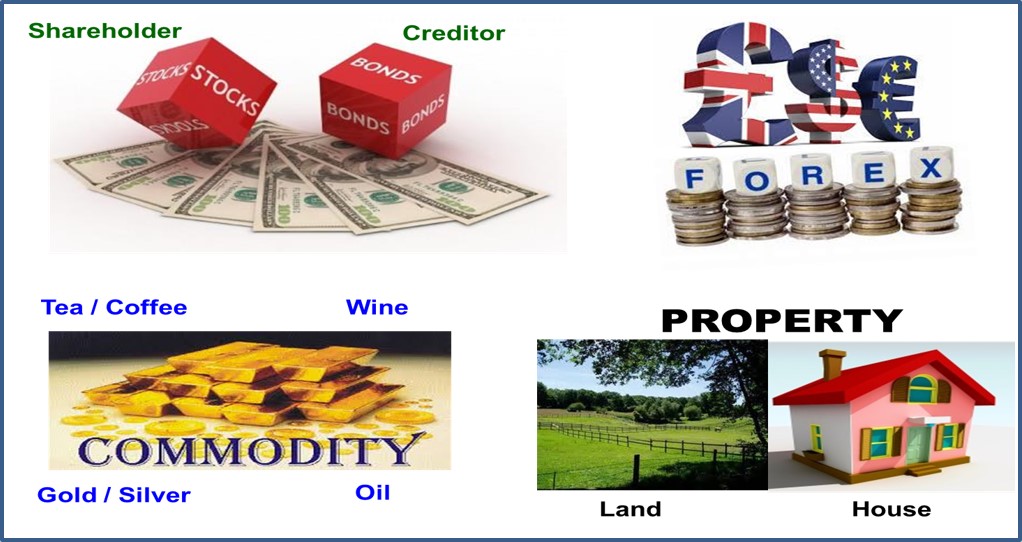

Stocks (eg. Dow Jones Index / individual stocks), Commodities (eg. Gold / Crude Oil), Bonds (eg. US treasury / corporate bonds), Properties (house / land), Forex / Cash, are 5 different investment markets, behaving in unique way with different market cycles, capital gains and probability of success. Investors need to choose or consider the right investment market as an overall investment portfolio, aligning with own unique personality. Let’s learn the main selection criteria:

1) In all investment markets over the past 100 years, Stock Market is proven to have the most upside potential over a long term (at the expense of more uncertainties in shorter term for traders) but requiring knowledge of choosing giant stocks (strong fundamental stocks), ideally buying at low optimism of stock market cycle (eg. during global financial crisis) and hold for long term or selling high at next high optimism of stock market cycle. Many investors fail due to selection of junk stocks with weak fundamental, holding for long term, resulting in tremendous losses (when company goes bankrupt eventually, share price would drop to $0). Strong fundamental giant stocks could grow in both business and share prices over 10 times or even 100 times over decades of long term investing.

2) Property Market by default is a giant (especially for country such as Singapore or Hong Kong with limited land and growing population and rising economy over the decades), main investment tool is leveraging (loan, which is similar to CFD in stock market) for higher return, best to integrate with low optimism of property market cycle (usually 3-6 months after the low optimism of stock market cycle), hedging against inflation (about 2-3% yearly) and collect rental income with capital gains. Property stocks or REITs are hybrid of property and stock markets, having the value of property and cyclic nature of stock prices.

3) Bond Market is lower return and “safer” but some could end up as junk bonds (eg. Hyflux and some oil & gas companies in crisis), business with high debt and negative operating cashflow or losses with high bond yield is a potential value trap as it may not be sustainable in long term. In the current market, short term corporate bonds are relatively safer (<12 months maturity) if the companies have strong fundamental, could be better than cash as parking fund to wait for next investment opportunity while enjoying higher return than bank interest for cash deposit in banks or government bond (eg. Singapore Saving Bond).

4) Commodity Market usually has longer market cycle (eg. about 20 years for crude oil, 30 years for gold), may not be suitable for long term investing as it could not generate passive income as stock (dividend) or property (rental) or bond (coupon) or even cash (interest). Commodities are mainly for trading to buy low sell high, knowledge of optimism in market cycle (short term or long term) will be important.

5) Cash is King when used at the right time. When other investment market optimism is high, investors may take profits, % cash or safe fund (eg. government bond) will be relatively higher as opportunity fund. Holding cash in different currencies require understanding of Forex. Saving cash in SGD has strength for holding (moderate appreciation against most global currencies) but more importantly, cash has to be converted into other investment opportunities above at certain point for higher return.

Learn from Dr Tee in Free 4hr investment courses to learn the investment clocks of Stocks, Properties, Commodities, Bonds and Forex / Cash: What to Buy, When to Buy / Sell. Register Here: