Most people may think Singapore stock market is stagnant but actually it is a good time for big funds to acquire good business at low price. Previously Ein55 Graduates have gained from acquisitions of SMRT (by Temasek) and Sim Lian (by Chairman, Mr Kuik). The target this time is on Super Group which Ein55 Graduates have prepared, following Dr Tee Optimism Strategy.

Super Group (SGX: S10) is one of the Top-10 food & beverage stocks in Singapore, based on Optimism Strategies with consideration of FA (Fundamental Analysis), TA (Technical Analysis) and PA (Personal Analysis). Let’s learn how to grab the next opportunities following similar approach, taking action ahead of the potential big bunds.

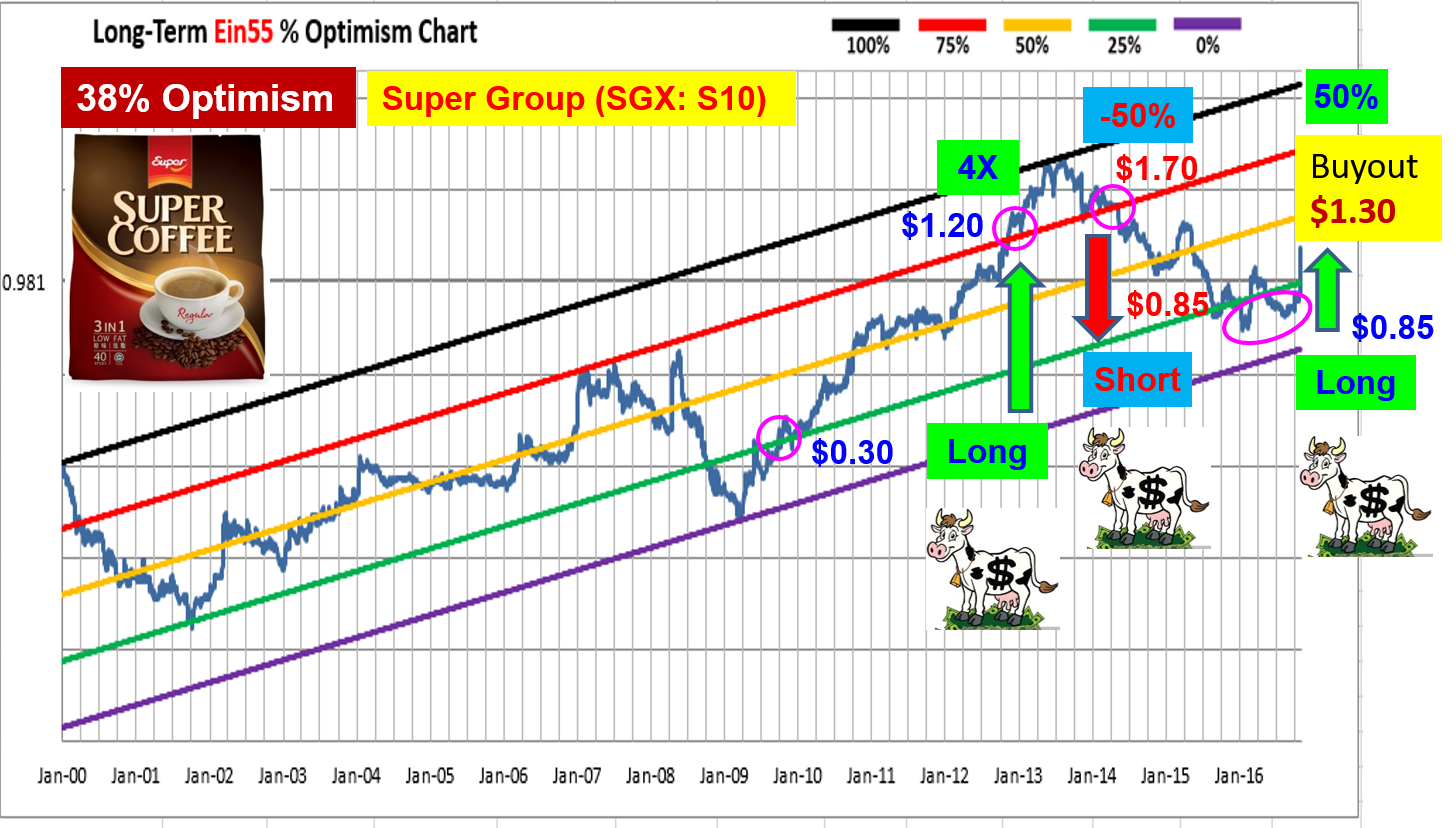

Super Group is a strong cash cow in the defensive food & beverage sector. Following Optimism Strategies (see chart below), there are 3 opportunities in the past 7 years for an investor/trader to gain repeatedly from this giant stock:

Opportunity #1 (Long): From Years 2009 to 2013

It was a bullish period for Super Group as earning is tripled during this period. An investor could buy <25% Optimism ($0.30 or below) and sell >75% Optimism ($1.20 or above), minimum gain is 4 times!

Opportunity #2 (Short): From Years 2013 to 2016

In the last 3 years, due to regional economy slowdown and strong competition in consumer market, profit has declined, share price has dropped from over $2 to $0.80, about 1/3 of the peak price. A trader could gain tremendously from the falling down of prices through shorting strategy, from high optimism ($1.70) to low optimism ($0.85).

Opportunity #3 (Long): From Year 2016 till now

Falling in earning of Super Group has stabilised this year, share price below $0.90 is considered low optimism, suitable for investor to buy low again. There is no surprise when the Dutch fund has decided to offer to acquire super Group recently as they know the true value of his own business. As a result, Super Group share price went up 50% in the last 1 month from $0.80 – $0.90/share, approaching offer price of $1.30/share, gain of 50% in a short time.

We should learn to find the Top 10 food & beverage stocks in Singapore with high value, buying at discounted price at low optimism, ahead of other potential big buyers who are also looking for these cash cows. Investment clock is very critical to profit consistently from stock market.