In the ancient time, Europeans thought that swans are all white in colour until one day, black swan was found in Australia, it became a surprised news. Black swan event is a financial term used to describe an unexpected event which later evolved into global financial crisis. There were people and company went bankrupt during the downfall of global stock market. There were also people who took advantage to buy good business at low price, making many times of fortune in a short time when the crisis is over.

Every crisis is an opportunity. However, there are different scales of financial crisis, from Level-1 (company level, eg. Swiber or Noble), Level-2 (sector level, eg. Shipping Industry), Level-3 (country level, eg. Russia) to Level-4 (global financial crisis). Level-1 crisis happened almost all the time, weak company could wind up the business when the earning, asset or cashflow is insufficient to pay for the debt. Level-2 crisis follows the unique sector market cycle, eg. Oil & Gas crisis, casino crisis, opportunity could be found every few months, suitable only for trading if it is not aligned with higher level of crisis. Level-3 crisis could happen every year, eg. Euro Debt Crisis (2010-2012), US losing AAA credit rating (2011), China stock crisis (2015), Brexit crisis (2016), creating a good opportunity for both traders and investors. However, none of them could be named as Black Swan event or Level-4 crisis (global financial crisis), similar to Dotcom Bubble (2001) and Subprime Crisis (2008).

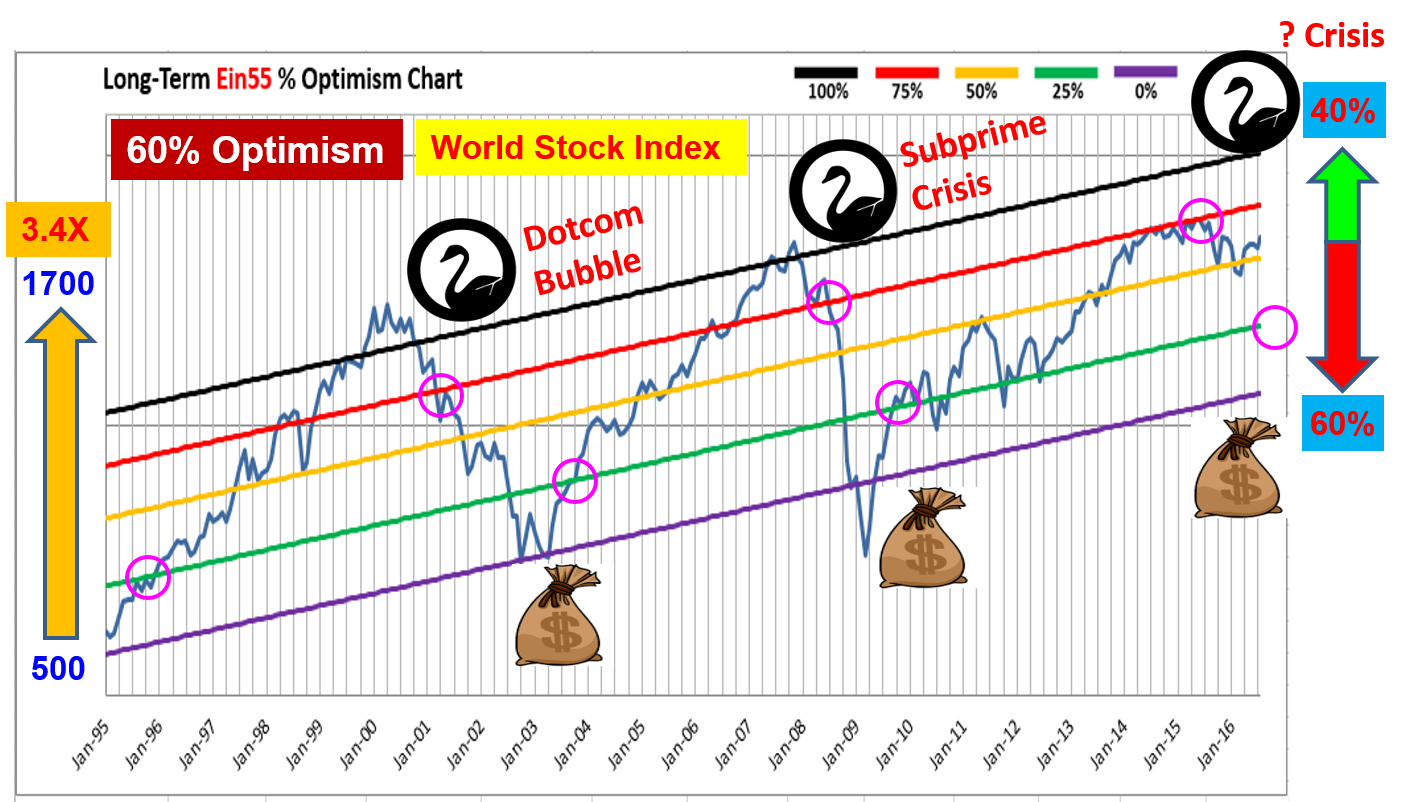

The greatest investment opportunity requires the most fearful financial crisis in an in unexpected way. Every year in a bull market, many “Dr Doom” will try to predict each event could become the next global financial crisis, but why it usually ended up just a smaller scale of regional crisis? In fact, each of the yearly financial crisis could become the next global financial crisis but it requires greater fear to trigger. Based on Ein55 Optimism Strategies (see chart below), global financial crisis will more likely to occur when world stock index is over 75% optimism, eg. in year 2000 (which triggered the dotcom bubble in 2001) and year 2007 (which triggered the subprime crisis in year 2008). For other smaller scale crisis (Euro Debt, Brexit, US credit crisis, etc), world stock market was at mid optimism level (<60%), it was not greedy enough, therefore the global investors were also not fearful enough to escape at the same time when crisis happened.

In the past 20 years, world stock market has gone up 3.4 times in share prices (see chart below), a highly profitable investment option. World stock market index was at the critical 75% Optimism in year 2015, the global stock market correction has helped to cool down to moderate high level of 60% Optimism. With US S&P500 index reaching historical high every few months, world stock market has been increasing in optimism level, risk is getting higher each day (40% upside, 60% downside) but not back to the critical level yet. If there is still a last rally, global stock market could be speculated to a high optimism level, the black swan of the next global financial crisis will be likely to wait there. We don’t have to guess what and when is the black swan event because it is unpredictable in nature, therefore it is called a black swan. However, Ein55 Optimism Strategies could help us to prepare for that golden opportunity in future. As long as we are not too greedy, taking profit at high optimism (>75%), we could save enough capital, overcome our fear to buy low at low optimism (<25%) and hold until recovery of world economy, making profit from global financial crisis.