There are total of 40 Singapore REITs, a popular investment option for retirement through passive income. By law, 90% of disposable income from Singapore REITs must be redistributed back to shareholders through dividends. However, not all the Singapore REITs are profitable, an investor could lose money if choosing the wrong one, eg. pursuing the highest yield REIT. REIT is an integrated investment between stock market and property market, knowledge of both markets are required to be successful.

In general, a good REIT should have strong fundamentals and DPU (Distribution per Unit) should grow over the time. At the same time, we could also profit from good REITs through capital appreciation of share price and net asset value of properties. A good REIT investor not only knows how to choose the REIT, but also masters the investment clock to buy / sell / hold the REIT. Let’s learn together with the case study below on Capitaland Mall Trust.

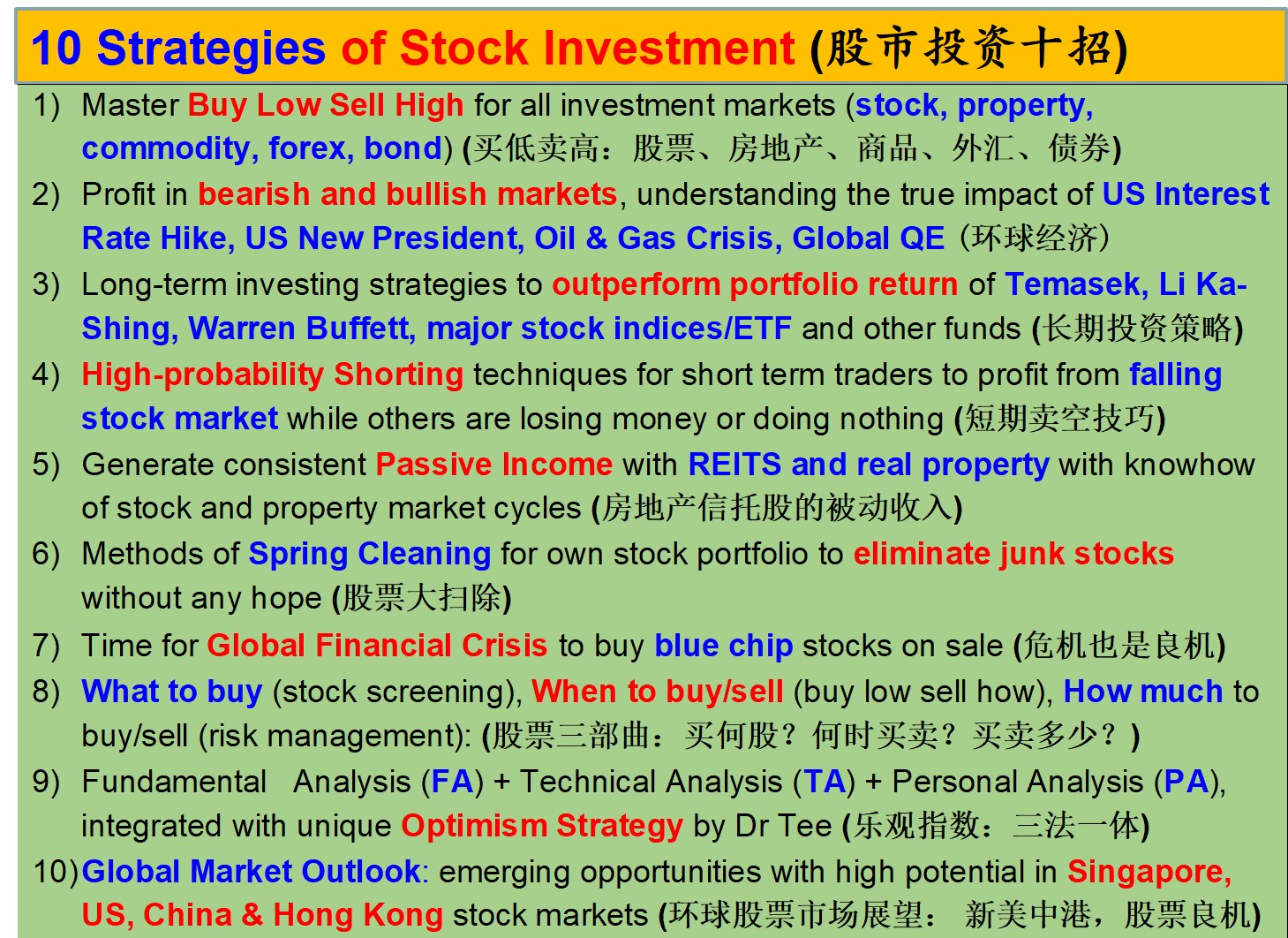

Capitalmall Trust (SGX: C38U) is one of the Top 10 Singapore REITs, based on Optimism Strategy with consideration of FA (Fundamental Analysis), TA (Technical Analysis) and PA (Personal Analysis). The DPU, dividends and operating cashflow are increasing over the years, current dividend yield is about 5%. At the same time, an investor could have profited 3 times in capital gains of share price ($0.75 to $2.25) from IPO till now (see chart below).

Ein55 Optimism of Capitamall Trust is 35% now, implying the upside is more than downside for its share price in long term perspective. When Optimism is below 25% for Capitamall Trust (Level 1), Singapore REITs Index (Level 2), Straits Times Index (Level 3) and MSCI World Index (Level 4), it will be an ideal time to become REITs investor. The dividend yield could be significantly increased if an investor could wait patiently for this REIT giant to fall down in share price during the next regional or global financial crisis. After buying low, when the REITs have recovered again, an investor will have an option to sell high to take profit for capital gains or hold long term for passive income.

We should learn to find the Top 10 Singapore REITs with excellent business for our investment portfolio, buying at discounted price at low optimism, ahead of other potential big buyers who are also looking for these valuable assets. Certain REITs stocks could be in crisis when the interest rates are higher and the property cooling measures last for another few more years. Therefore, we should only consider giant REITs stocks with strong fundamentals, not just any stock with price discount, buy low and sell high or hold patiently for both capital appreciation and passive income.

The safest time to buy a stock is when everyone is afraid the sky will fall down while the business is still operating normally with consistent performance. This could be a rare opportunity to buy during a crisis, we should learn how to take this advantage to truly buy low sell high.

When Optimism Strategies are combined with Fundamental Analysis (value investing & growth investing), Technical Analysis (support / resistance / trends), and Personal Analysis (mind control of greed and fear), it is very powerful when one is able to take the right action (Buy, Hold, Sell, Wait or Short) at the right time aligning with own personality.

The unique Optimism Strategies developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc) to buy safely, when to buy, when to sell, including option of long term holding. So far over 20,000 audience have benefited from Dr Tee high quality free courses on Singapore REITs and high dividend stocks to the public. Take Action Now to invest in your financial knowledge, starting your journey towards financial freedom!

Bonus #1 for Readers: FREE Investment Courses (including Singapore REITs) by Dr Tee

Bonus #2 for Readers: Dr Tee Investment Forum with over 6000 members (Private Group)

(Please click “JOIN” with link below and wait for Admin approval of membership)

- Market Outlook (stocks, properties, bonds, forex, commodities, macroeconomy, etc)

- Optimism/ Fundamental / Technical / Personal Analyses

- Investment risks & opportunities

- Dr Tee graduates events and activities updates