Singapore property market becomes bearish over the past 3 years after 7 rounds of cooling measures by government. As a result, Singapore property stocks become more valuable with stagnant stock price and high property asset value. There are many property counters in Singapore with share price below the net asset value (NAV), i.e. Price to Book ratio, PB < 1. These stronger property stocks become the potential target for merging and acquisition. Potential buyers and investors learn to buy good assets at discounted price, therefore considering good Singapore property stocks during bearish property market now.

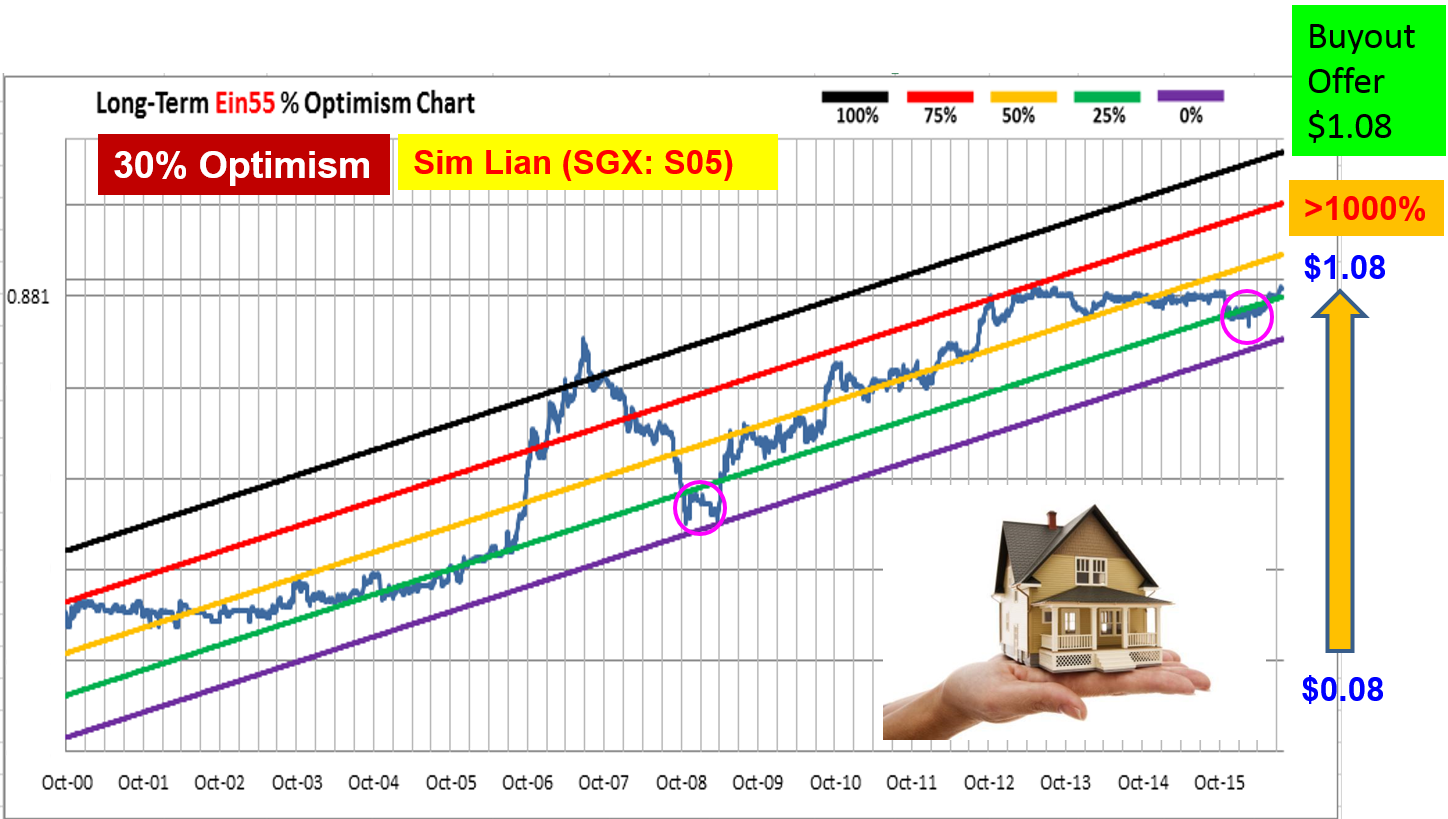

Sim Lian (SGX: S05) is one of the Top-10 property stocks in Singapore, based on Optimism Strategy with consideration of FA (Fundamental Analysis), TA (Technical Analysis) and PA (Personal Analysis). There is no surprise when the Chairman and major shareholder, Mr Kuik, has decided to offer to acquire Sim Lian recently as he knows the true value of his own business. Although the buyout offer of $1.08/share is the historical high price, if we analyse deeper, since the IPO in year 2000, both the share price and NAV have grown up more than 10 times with dividend yield of about 8% (based on last price before acquisition), this is only a fair price as the value has grown up as well over the years. In fact, Sim Lian has been at low optimism (<25%) over the past 1 year before the acquisition news, the second best investing opportunity since the subprime crisis in years 2008 – 2009, when it was also at low optimism. The offer price of buyout ($1.08/share) is near to NAV of the stock, the return compared to Day1 of stock price ($0.08/share) is over 1000% return in the last 16 years.

We should learn to find the top 10 property stocks in Singapore with high value, buying at discounted price at low optimism, ahead of other potential big buyers who are also looking for these valuable discounted assets. Property stocks could be in crisis when the interest rates are higher and the property cooling measures last for another few more years. Therefore, we should only consider giant property stocks with strong fundamentals, not just any stock with price discount, buy low and sell high or wait patiently for future acquisition.