Every crisis is an opportunity. We have learned to be greedy when others are fearful. However, not everyone is mentally prepared to buy low and sell high following one’s personality. When a business is in crisis, the stock price is like a falling knife, one could get hurt when enters too early, buy low and may get lower, emotionally affected with the endless falling prices.

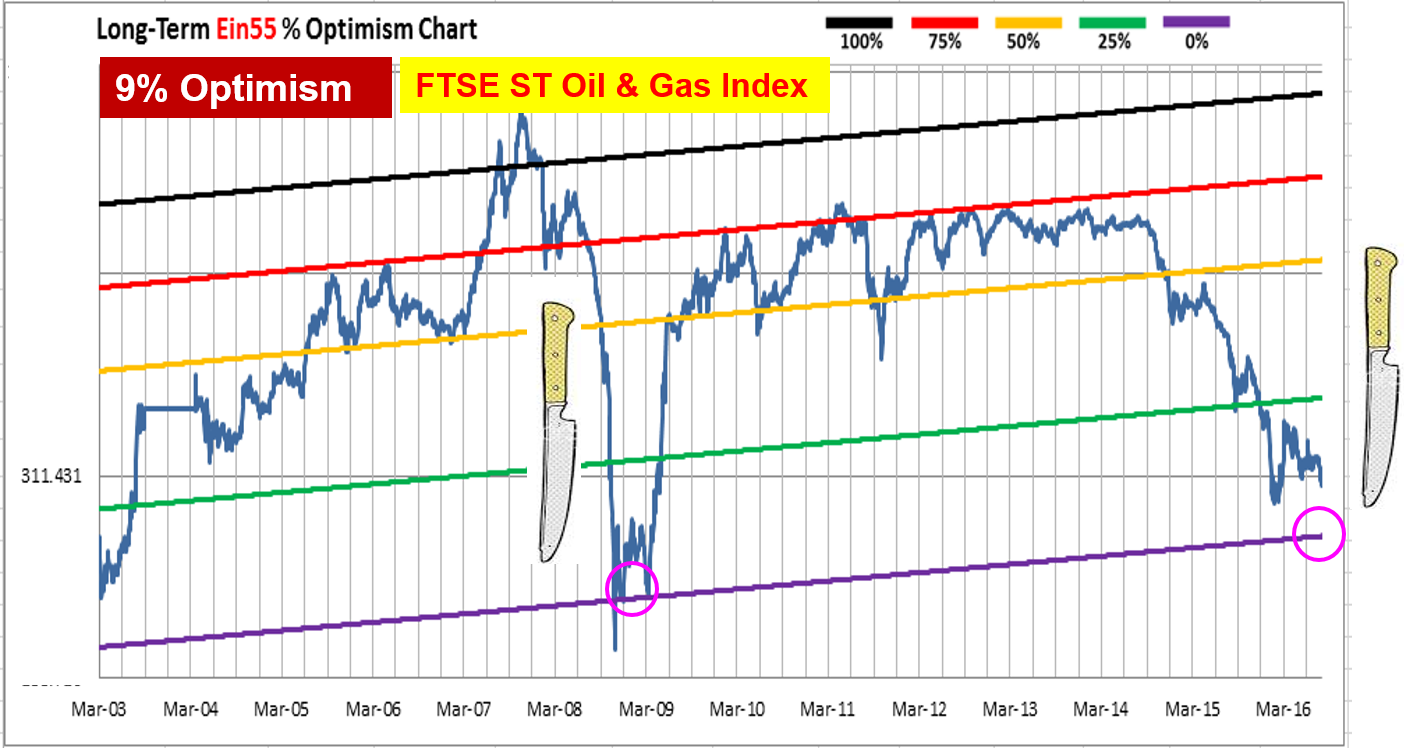

For example, over the last 2 years of crude oil crisis, stock prices of global oil & gas stocks are significantly corrected. Singapore oil & gas stock index is at 9% optimism (see chart below), a very attractive price level over the last 10 years, upside is much higher than downside from a long term perspective. However, whenever there is a technical rebound due to good news (eg. recovery of crude oil price), there could be another negative news who correct it down further (eg. Swiber plans to wind up the business recently).

Here are a few important considerations for us to safely capture the falling knife of a stock in crisis:

1) Fundamental Analysis

Some weaker stocks may not survive through the crisis. It is critical to always consider giant stocks with strong fundamentals. Based on the survival of the fittest, after the winter is over, these strong stocks will grow stronger, especially there are less competitors with higher demand then. For more conservative investors, one could wait patiently for signs of reversal in the business performance.

2) Technical Analysis

While long term view of a stock could be at attractive low price, the intermediate price trend usually is bearish for a stock or sector in crisis, eg. commodity, shipping, casino, etc. It is important to follow the trend before entry, waiting for the falling knife to drop the floor first, before pick it up safely. Confirmation of uptrend is required, aligning Level 1 (individual stock), Level 2 (sector / industry), Level 3 (country / region) and Level 4 (whole world).

3) Personal Analysis

One should know own’s personality before deciding whether short term trading or long term investing is a more suitable approach. It is hard to force a trader to buy low and wait for several years to have tremendous capital gains. At the same time, a true investor could grab an opportunity even with counter trend in prices, ignoring the daily market news, using strong holding power to reverse the trend eventually, buy low sell high.