The Brexit crisis is a blessing in disguise, many people sell away their best stocks out of fear, creating a rare opportunity to buy blue chips at intermediate low prices. People worry about the status of London as global financial center, many bank stocks are affected. Share price of top UK Bank, Barclays, was falling by 30%, while global major banks such as JP Morgan and Citigroup, were corrected more than 10% in share prices.

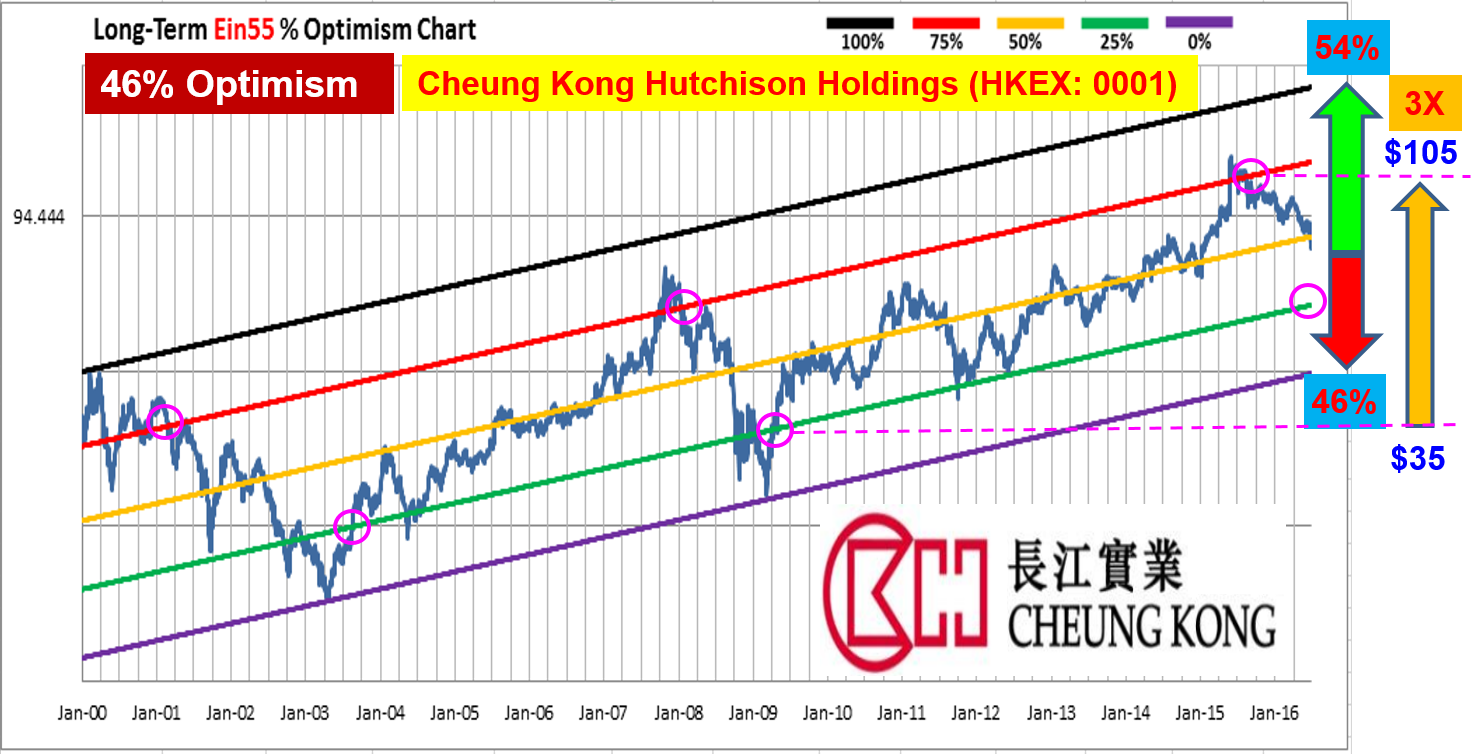

Many global blue chip stocks with business in UK, become target for speculation. The richest man in Asia, Li Ka-Shing, suffers the most. The #1 stock in Hong Kong (Cheung Kong Hutchison Holdings, HKEX: 0001), is severely corrected is stock price, currently at $82, down by about 1/3 from its peak price of $122 (see chart below). In the last stock market cycle, an investor could apply Optimism Strategy developed by Dr Tee to buy Cheung Kong at $35 (25% Optimism) in year 2009, selling at $105 (75% Optimism) with potential gain of 3 times. Usually it is hard to wait for the giant stocks to fall down, Brexit has helped to correct the long-term Optimism to 46%, getting closer for an investor to consider again. At the same time, mid-term Optimism of Cheung Kong is down to 0%, an attractive price for trading.

This is a rare opportunity for investor, share price correction is partly due to Brexit, economy slowdown in Hong Kong / China and major correction in Hang Seng Index (HSI). Optimism is a probability calculator, we could estimate the reward to risk ratio, we could safely consider a good stock if we could wait for the giant to fall down. However, the short term trend is negative due to bearish global stock market sentiments, an investor could apply trading strategy to buy this stock when sentiment is positive again.

When Optimism Strategies are combined with Fundamental Analysis (value investing & growth investing), Technical Analysis (support / resistance / trends), and Personal Analysis (mind control of greed and fear), it is very powerful when one is able to take the right action (Buy, Hold, Sell, Wait or Short) at the right time aligning with own personality.

The unique Optimism Strategy developed by Dr Tee provides a special advantage to know which investment (stock, forex, property, commodity, bond, etc) to buy safely, when to buy, when to sell, including option of long term holding. So far over 10,000 audience have benefited from Dr Tee high quality free courses to the public. Take action now to invest in your financial knowledge, starting your journey towards financial freedom.

Brexit has created new stock trading and investing opportunities globally. At the same time, British Pound is severely corrected, one could apply Forex Optimism to maximize the gains in stock market. The fear factor has supported the bullish gold price and gold related stocks (eg. gold miners), analysis with Commodity Optimism is needed. Every crisis is an opportunity, provided one knows how to position.