As we know, casino has unfair advantage of over 51% chances for all the games, therefore even a gambler has a 49% winning rate, over a long time with many times of gambling, the survival rate could be very low. However, in the world of stock market, we could reverse the situation, playing the role as casino with unfair advantage on us, if we know how to position the right strategy, aligning with our personalities.

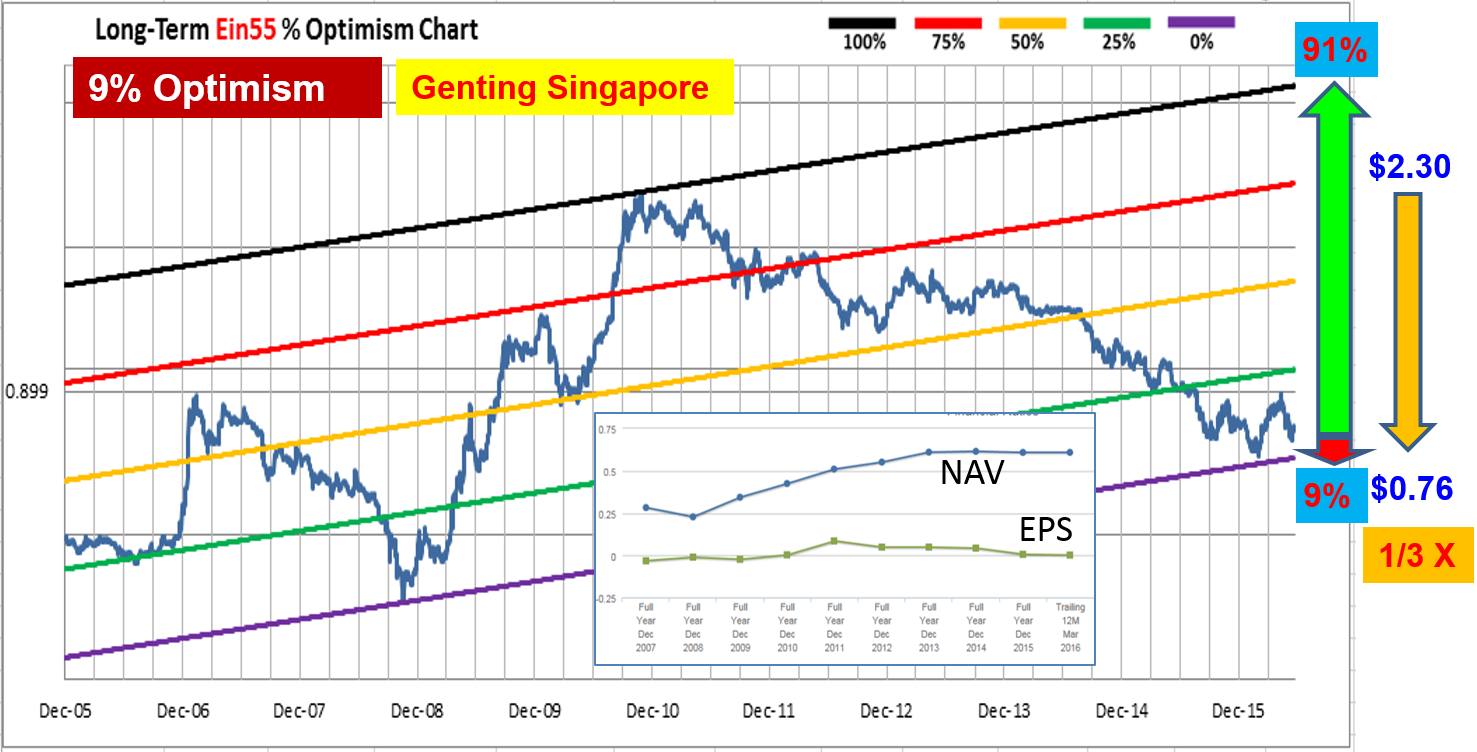

Genting Singapore (SGX: G13) has suffered huge correction in share price to about 1/3 of the peak price. In the past few years, earning of Genting Singapore and global casino stocks have declined due to slowdown in global economy. Weaker Malaysian Ringgit and anti-corruption in China have further reduced the gamblers from these 2 main markets. The net asset value (NAV) of Genting Singapore is still growing gradually, helping to stabilize the business.

Long-term Optimism of Genting Singapore is 9% at current share price, low downside and high upside. This is a rare opportunity for investor (second best opportunity after the last global financial crisis in 2008-2009). Optimism is a probability calculator, we could estimate the reward to risk ratio, we could safely consider a good stock if we could wait for the giant to fall down. However, the medium term trend is negative due to weak fundamental of business, therefore only investors with long term holding power could enter with counter trend (price could become lower in short to medium term). If not, trading strategy could be considered, waiting for higher share price with breakout of next resistance, buying after short-term uptrend is established.

At the same time, trader could also profit from shorting the casino stocks at short to medium-term high optimism. There is no single answer to trading or investing decision which has to be aligned with one’s personality (short term trader, medium term trader or long term investor).

Currently global casino stocks are under Level 2 crisis, suitable for medium term trading but technical analysis should be applied before entry. For long term investing, this stock may be considered during Level 3 (regional crisis) or Level 4 crisis (global financial crisis) one day when optimism of world stock indices are low. Global casino business is at winter time now but this is a cyclic business, a gambler may not stop gambling forever. When global economy has improved, the gamblers will come back again to support the casino business. For trader and investor, the only question is what price to buy for casino stocks?