In the vacation trip to Hong Kong with family, I also take the opportunity to study a few good Hong Kong stocks through actual involvement as a customer of their business. This strategy is called Personal Analysis (PA), also applied by Peter Lynch, the best Fund Manager, who identified the best businesses through daily life observations.

Since we were hungry, we have decided to go around the Nathan Road near Mong Kok area. We ran across Café de Coral (大家乐), a local Hong Kong fast food restaurant. We could not even find a seat at 6pm, business was so good. Then we walked further, there is another branch, manage to find a seat after waiting.

We ordered baked rice, the portion is so big and the taste is good, although it was prepared in about 5 min. The business continue to be good, full house until 7:30pm when we left. We walked further, seeing a few more Café de Coral. It seems to be more popular than McDonald in Hong Kong, so many branches and business are good.

Daily life observation is a powerful investing technique (Personal Analysis, PA) when combined with Fundamental Analysis (FA) to confirm Café de Coral indeed has strong earning and cash flow records. An investor could then apply Optimism Strategy to buy a share of this business through stock market, ideally at Level 3 or Level 4 crisis for investing, or Level 2 crisis for trading, adding Technical Analysis (TA) and macroeconomy analysis of Kong Kong if needed.

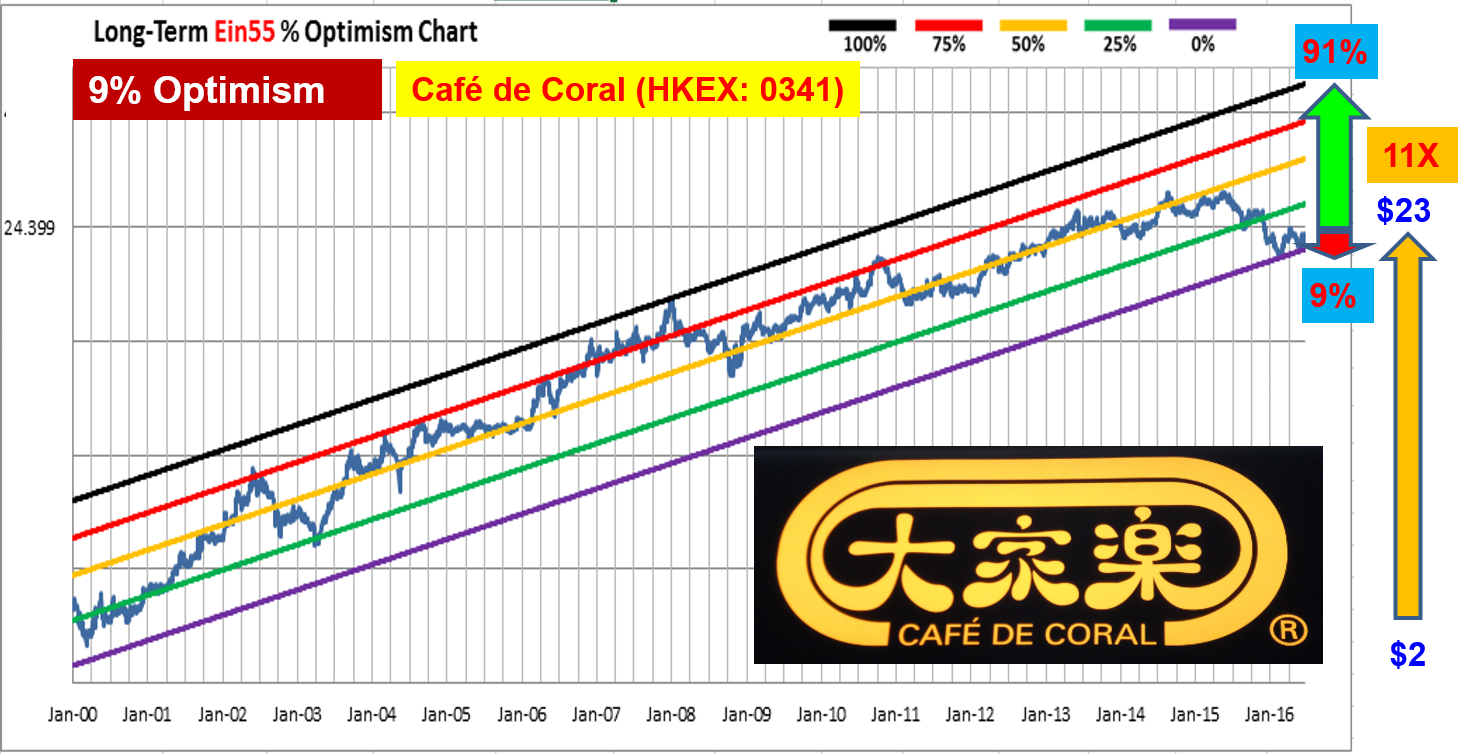

Café de Coral (HKEX: 0341) has increased in share price by more than 11 times in the last 16 years. Long-term Optimism of this giant fast food stock is 9% at current share price, low downside (9%) and high upside (91%). This is a rare opportunity for investor, share price correction is partly due to economy slowdown in Hong Kong and major correction in Hang Seng Index (HSI). Optimism is a probability calculator, we could estimate the reward to risk ratio, we could safely consider a good stock if we could wait for the giant to fall down. However, the short term trend is negative due to bearish global stock market sentiments, therefore only investors with long term holding power could enter with counter trend (price could become lower in short term). If not, trading strategy could be considered.