Due to global economy slowdown in the last few years, stock markets in the emerging countries have suffered significant corrections, resulting in Level-3 (country/region) crisis. The leaders of emerging countries are BRICS (Brazil, Russia, India, China & South Africa), stock prices are now at very attractive prices. When the global economy starts to recover and accelerate, these emerging stock markets will benefit as well. One could use ETF to trade or invest global stock indices.

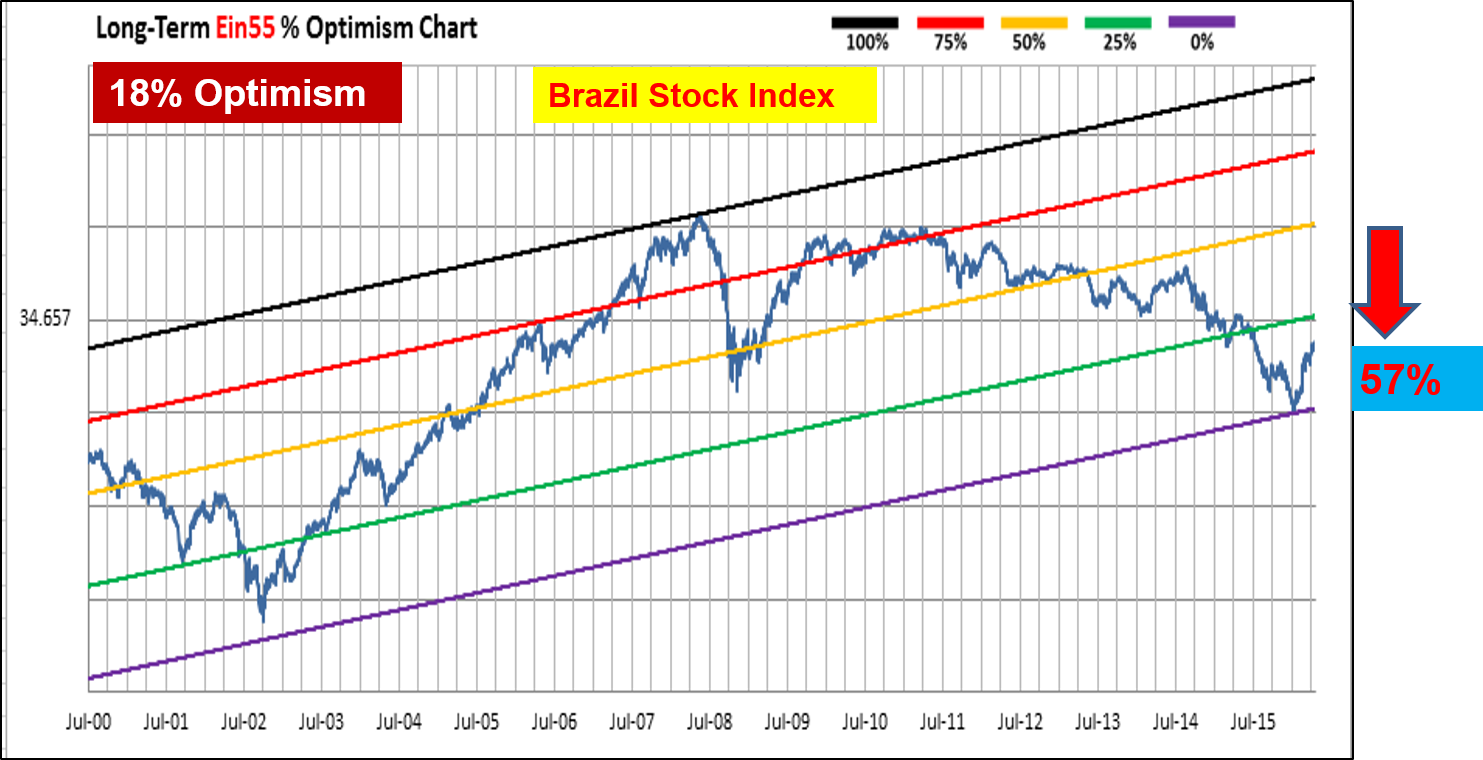

Due to economy and political instability, Brazil stock market now is at 18% Optimism, after 57% correction in stock prices (see chart below).

Russia has suffered from falling in global oil price, economy is severely affected. Russia stock market now is at 16% Optimism, after 65% correction in stock prices (see chart below).

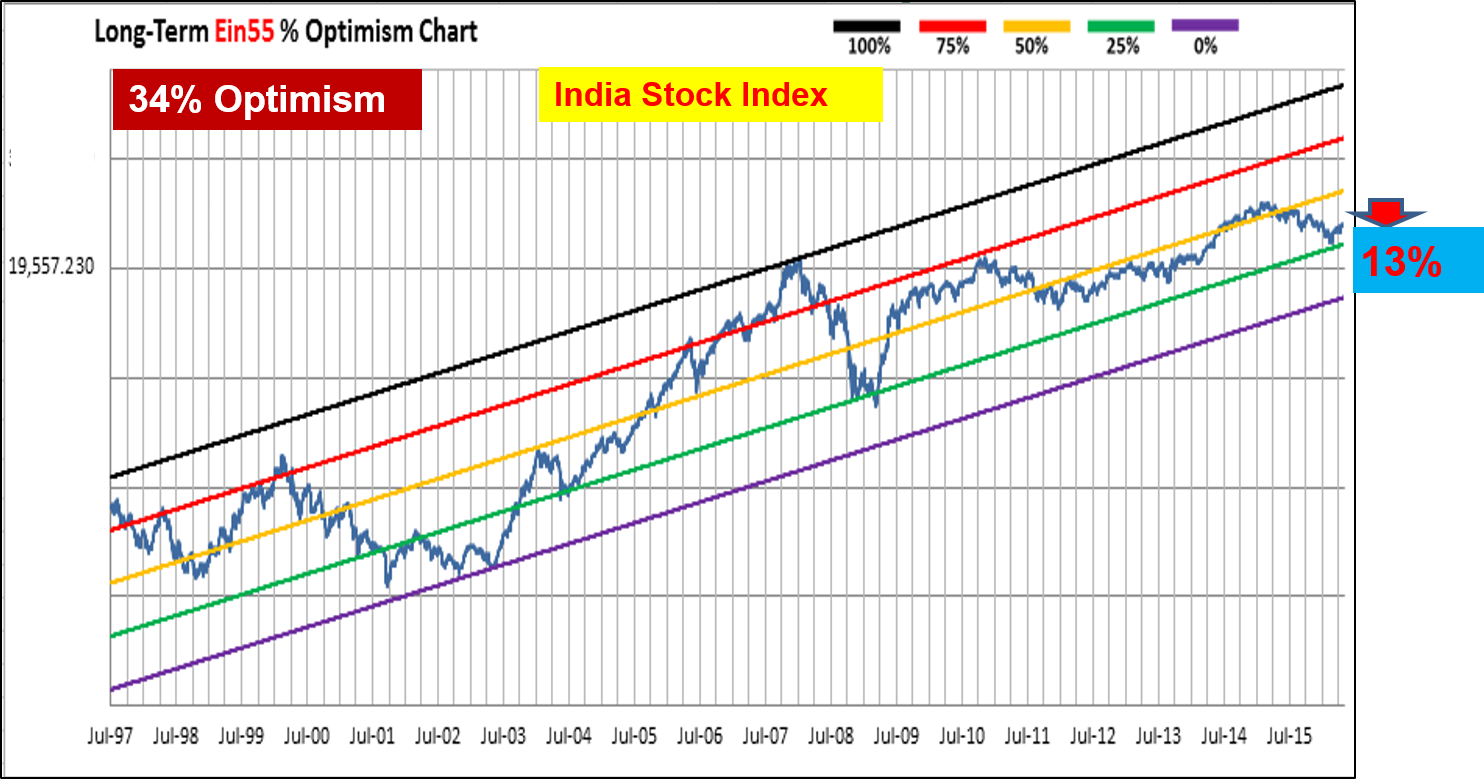

India is relatively stronger compared to other BRICS, stock market now is at 34% Optimism with only 13% correction in stock prices (see chart below).

China is world No 2 economy, although Optimism is similar to India at 34%, stock prices have heavily corrected by 43% after the last round of speculative bull run, falling down from peak of 5200 points (see chart below).

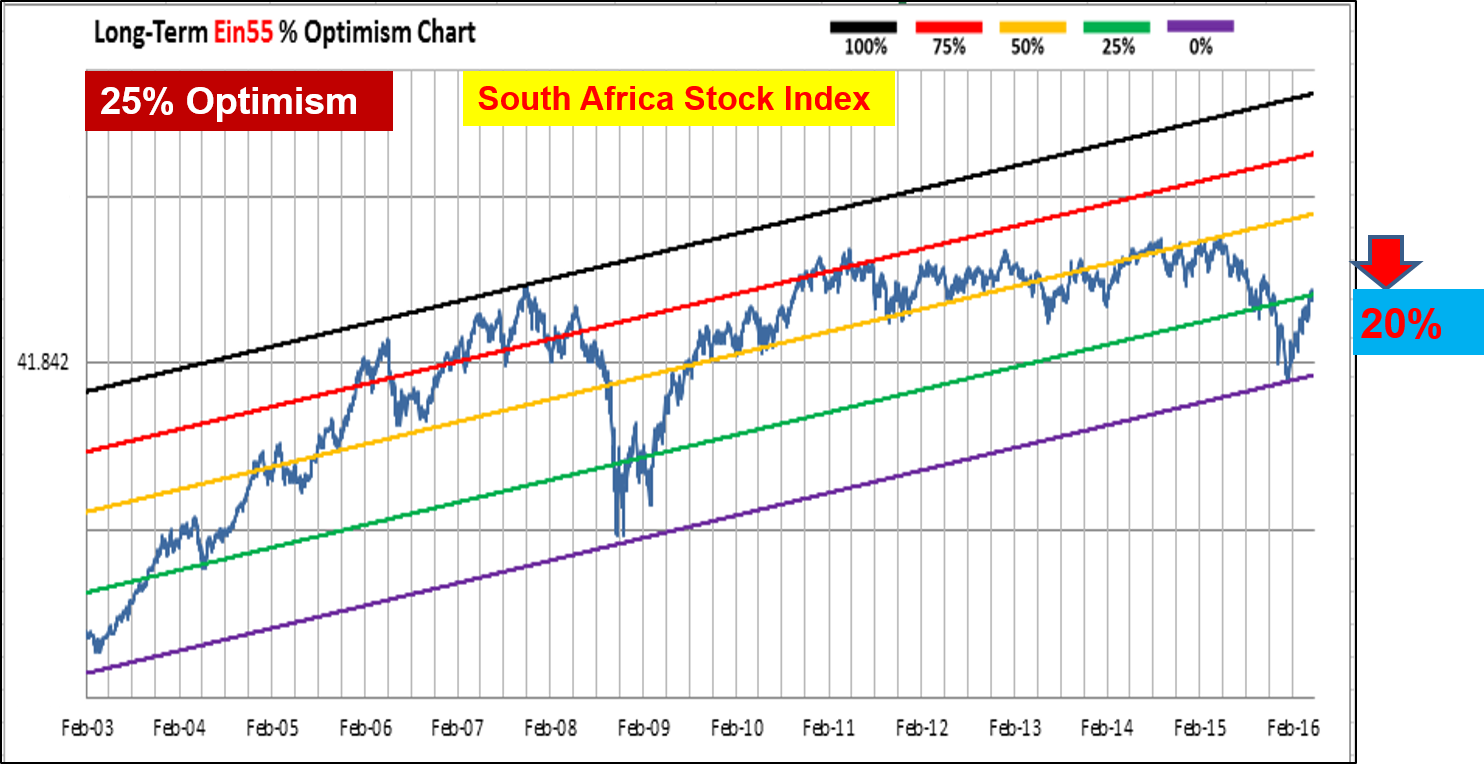

South Africa is relatively smaller in economy size, Optimism now is at ideal 25% Optimism with only 20% correction in stock market (see chart below).

The level-3 crisis and opportunity mentioned above requires longer investing strategy because global economy recovery is a gradual and longer term. Political economy is also crucial for the recovery of stock markets. BRICS have to compete with US which is now at moderate high Optimism of 68% (see chart below) with more bullish economy, challenging the next historical peak in stock prices.

If there is still a last global rally in stocks, BRICS may recover strongly with US stock market may rise to new historical high. Other smaller emerging countries stock markets (eg. Southeast Asia) and many individual stocks may follow BRICS as well. However, after the next bull run, there could be another perfect storm waiting ahead, level 4 global financial crisis may severely injured all the global stock markets, both US and emerging counties. The ability to know when to sell to take profit will be crucial.