Jardine Matheson Holdings (JMH) / Jardine Strategic Holdings (JSH) has over 180 years of history, the group includes famous brands such as Dairy Farm, Jardine Cycle and Carriage, Hong Kong Land, Mandarin Oriental, etc. Although JMH and JSH were removed from 30 STI components in 2015, it is still considered a blue chip, suitable for investing.

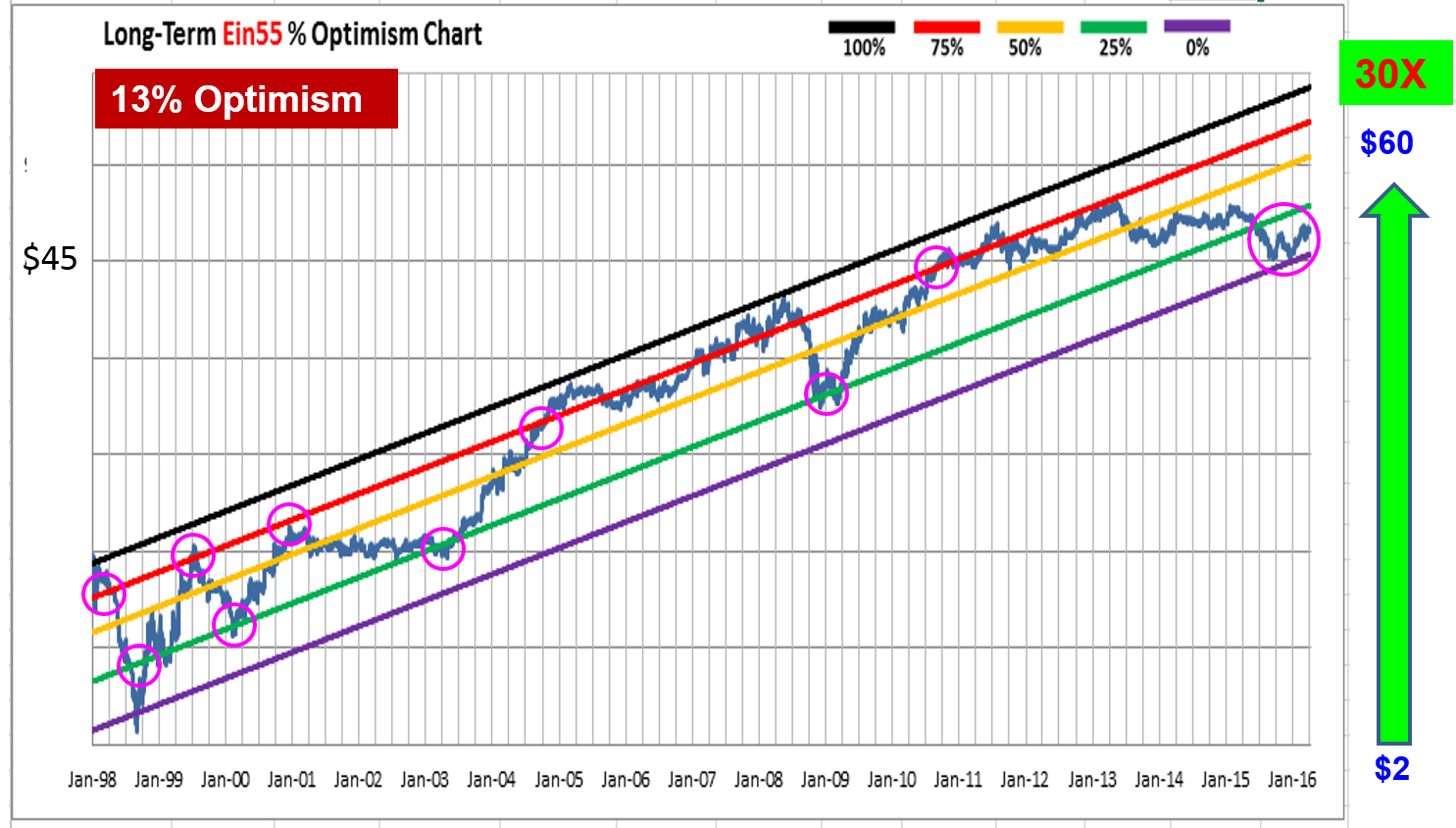

The chart below shows the stock price history of JMH over the past 18 years. For long term investors, there are 2 strategies for capital growth to achieve higher stock price:

1) Market Cycle Investing (Buy Low Sell High)

Long term optimism chart developed by Dr Tee could show the timing to Buy Low Sell High (circled, see chart), upside potentially in a few years usually could be around 50% – 200% (3X). This is an investing strategy integrating trading principle of buy low sell high, following the market cycles to buy/sell blue chips.

2) Value Investing (Buy Low Hold Forever)

Some investors prefer to buy and hold the stock over the lifetime. If the right stock is chosen, one could benefit from passive income (consistent yearly dividend) and also tremendous capital gains. From the chart shown, one could earn 30X if able to buy and hold JMH for the last 18 years.

The strong fundamental stocks with consistent earning could help to sustain the growing price over many years. Whether to Buy Low Sell High or Buy Low Hold Forever, it depends on investor personality. Not everyone can be a long term value investor because it involves 4 knowhow:

1) Know What to Buy

– not every stock is suitable for long term investing

2) Know When to Buy

– one could lose money if buying blue chips at high price, the ability to buy low will create safety margin to reduce the future risk

3) Know When to Sell or Continue to Hold

– a good stock now may not be a good stock in future, careful monitoring of yearly business performance is a must for long term holding

4) Holding Power

– emotional management of Fear and Greed is needed

How to find more stocks like Jardine which may have tremendous growth potential in stock prices? What are the potential of Jardine component stocks such as Dairy Farm, Jardine Cycle and Carriage, Hong Kong Land, Mandarin Oriental, etc? It will be interesting to understand these investing opportunities, from Level 1 (individual stocks), Level 2 (sector / industry), Level 3 (country / region) to Level 4 (world).